Transforming a community bank to a fintech with purpose

Radically modernising and digitising operations

increase in loan applications

71%decrease in number of customer actions to complete an application

9 to 1number of days taken to process an application

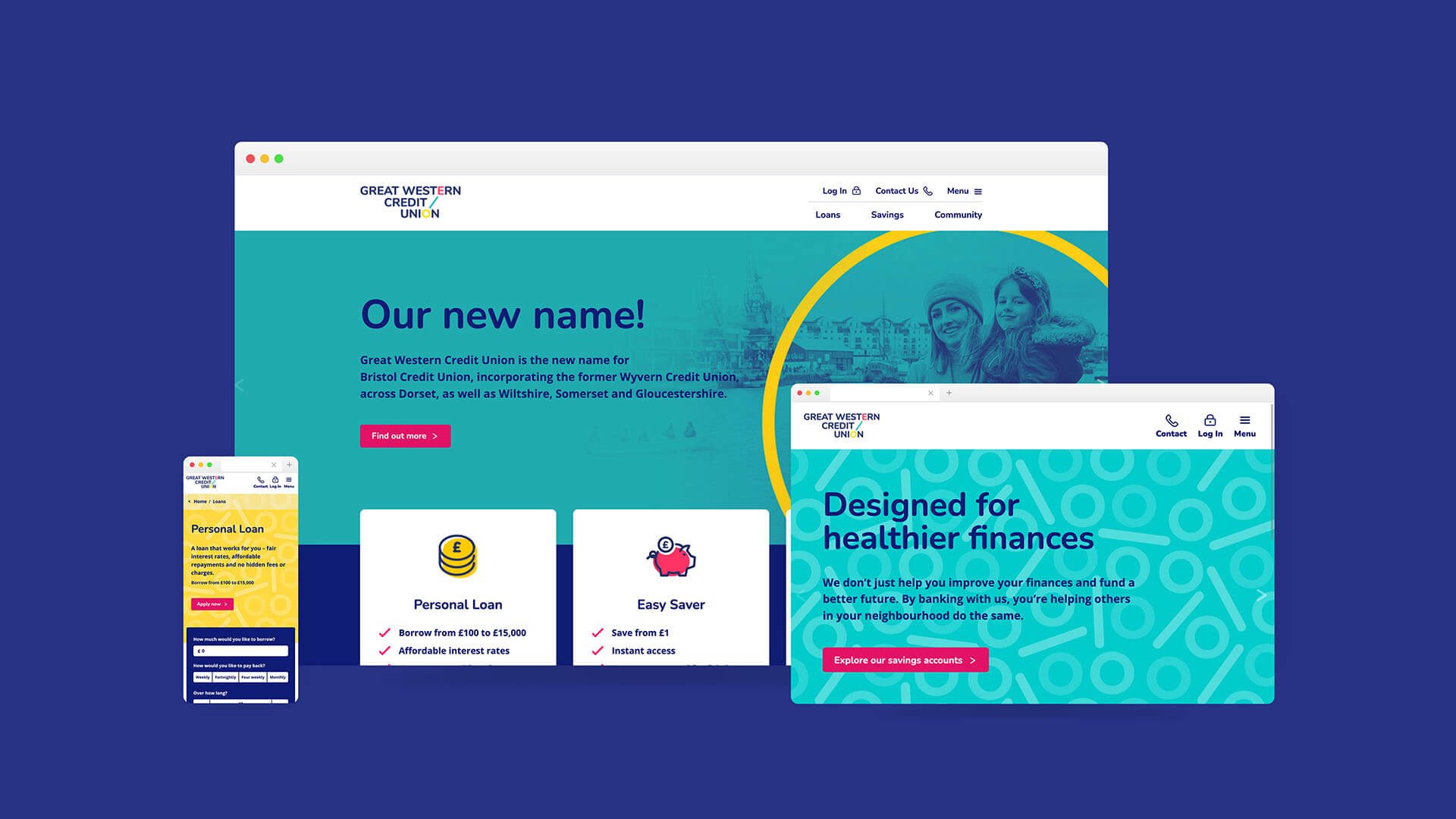

Great Western Credit Union (GWCU) has supported the financial well-being of thousands in their community, through the transformation of their loan applications, bringing low-cost ethical financial support to the people who need it at speed.

Powered by over 20,000 local members, GWCU’s mission is to make the communities and people it serves better off, by providing access to credit for those in need together with responsible financial advice and ethical loan and savings opportunities.

In 2019 achieving their mission in a fast-moving and competitive marketplace was proving highly challenging. GWCU needed to embark on a seismic technological shift. Their antiquated systems were no longer fit for purpose, resulting in data duplication, inefficient workflows and a lending experience that didn’t meet the needs or expectations of their mobile-first audiences.

Their remarkable journey has seen the organisation radically modernise and digitise its entire operations and their transformation has resulted in GWCU now being one of the largest cooperatives in the South West.

GWCU approached us with sizeable ambitions. Their goal was geographical expansion, yet their immediate desire was to offer a more inclusive, accessible, and agile lending experience to its members. The organisation wanted to create greater social impact and help people in their community to better manage their funds and receive access to affordable and flexible credit solutions.

Recognising that the bank’s use of technology must adapt to enable their strategic goals to be met, board members agreed an extensive transformation programme was needed, and so began the exploration into what GWCU, then Bristol Credit Union, could become.

- Digital strategy

- Digital maturity

- Managed transformation

- Change leadership

- User experience

Visit the website

Transformation

Our early discovery conversations set out to understand ‘why’ GWCU exists and its vision of the future. By building out the business case for digital maturity, we considered how digital solutions could be architecturally delivered to yield the greatest benefits to their members and realise their ambitions. From the outset, it was clear that the organisation’s existing systems and infrastructure were not fit for purpose and could not deliver their future aspirations. GWCU’s members deserved more, and the community bank needed to put the right, future-focused framework in place to be able to lend to more people without incurring more costs.

GWCU sought to deliver a service offer that would rival high street banks and payday lenders, and the board knew that if they continued to stand still it would likely mean that the opportunity to grow and deliver its purpose in the long-term would pass them by. The internal motivation to operate at scale, to work in a much more agile way, and to modernise community finance by pivoting to a ‘fintech with purpose’ was great.

User experience

To grow and evolve in a way that would always put people first, required a long-term transformation journey. The complete transformation encompasses GWCU’s back-end operations, its customer-facing digital ‘shop window’ and its supporting systems and infrastructure. This ultimately paved the way to a purpose-driven, user-focused and fully responsive offer that met the needs of today’s digital consumer whilst driving internal efficiencies. Enabling the team to provide services to a much wider customer base than ever before.

- Umbraco CMS

- MS Dynamics 365 CRM

- Automated decisions & Processing

The tech behind the application

The automation of loan applications and lending decision-making was made possible by building an online .NET web application to provide an intelligent and highly secure digital layer. This enabled the loan application process and member portal to integrate into the MS Dynamics 365 power platform seamlessly. This was supported by a front-end Umbraco CMS website, creating a mobile-first, SEO and digital marketing-optimised user experience.

The CRM solution was built in close partnership with Bristol-based Microsoft Cloud experts, Chorus. GWCU’s network and environment experts ADT Systems supported the overall Azure environment including ensuring multi-region backup/replication for core systems.

Security was front and centre throughout GWCU’s digital transformation journey to ensure that members and applicants were protected by bank-grade security. The platform leverages modern digital processes and services – such as multi-factor authentication – to prevent and protect against fraud. The multi-tiered application process was designed to incorporate all checking and ID verification stages, with applications running through an industry-standard third-party API, serving as the ‘lending engine.’

The right technology, designed and built with purpose, has provided Great Western Credit Union with the technology ecosystem needed to achieve real social impact by providing fair banking opportunities and supporting the financial well-being of communities across the South West.

Related case studies

Transforming a community bank to a fintech with purpose

- Strategy

Breaking down communication barriers

- Web

A safe space for young people to unite

- User experience

Award-winning UX for commercial success

- User experience

Redefining Promoting Dance in the Digital Space

- User experience

Going paperless: Streamlining efficiency and real-time insights

- User experience

Engaging young people to read through gamification

- App

A child-centred virtual learning environment

- App

Putting a smile on children's faces

- Strategy